Overview

Tax-wrapped investment accounts provide tax advantages to the investments it holds. The ‘wrapper’ confers a legal structure that changes how income, dividends, and capital gains are taxed - often deferring taxes, reducing tax liability, or offering exemptions altogether.

Tax-wrapped investment accounts are always linked to a national regulatory space. Upvest offers the general building blocks to allow a Client to offer tax-wrapped accounts to its customers, however, the specific requirements differ in each country. Currently supported tax wrappers include the United Kingdom's Individual Savings Accounts (‘ISA’) and France's Plan d’Epargne en Actions (‘PEA’).

Plan d’Epargne en Actions (‘PEAs’)

The Plan d'Épargne en Actions (“PEA”) is a regulated savings and investment account available in France that allows investors to build a portfolio of European assets while benefiting from significant tax advantages. These plans are designed for adult individuals who are tax residents of France.

The Investment API currently supports the PEA Classique, with plans to support PEA Jeune and PEA Petites et Moyennes Entreprises (PEA-PME) in the future.

Individual Savings Account (‘ISA’)

The Individual Savings Account (ISA) is a tax-advantaged savings and investment account available in the United Kingdom. It allows individuals to save or invest in a wide range of assets including cash, stocks, and funds, while benefiting from income tax and capital gains tax exemptions on returns and interest. Designed for adult UK residents, ISAs are a flexible tool for building wealth over time with annual allowances set by the UK government.

The Investment API supports both flexible and non-flexible Stocks & Shares ISA, with plans to support Junior ISAs (JISA) and Lifetime ISAs (LISA) in the future.

Core solution

The building blocks of our solution consists of:

Onboarding The Investment API supports all necessary steps to onboard an eligible user and their supported tax-wrapped products.

Managing allowances and contribution limits Each tax wrapped investment account has regulatory determined limits on how much customers can invest or save in the tax-wrapped product. This limit can apply to the tax wrapper’s lifecycle, or be determined annually in line with local regulations.

Deposits and withdrawals Each deposit and withdrawal impacts how much allowance remains available to customers to invest in their tax-wrapped account. Our event-driven architecture allows our Clients to be transparent towards their customers and prevent end-users from breaching limits.

End of tax year processes For tax-wrapped products with an annual allowance, the Investment API enables seamless processing. Changes to regulatory allowance limits are automatically factored into the allowance values for all onboarded customers.

With this guide, we will outline the integration steps for facilitating tax wrapped investment accounts in a seamless way.

You will gain clarity about how we manage the various end-of-year use cases and relevant edge cases.

Integration approach

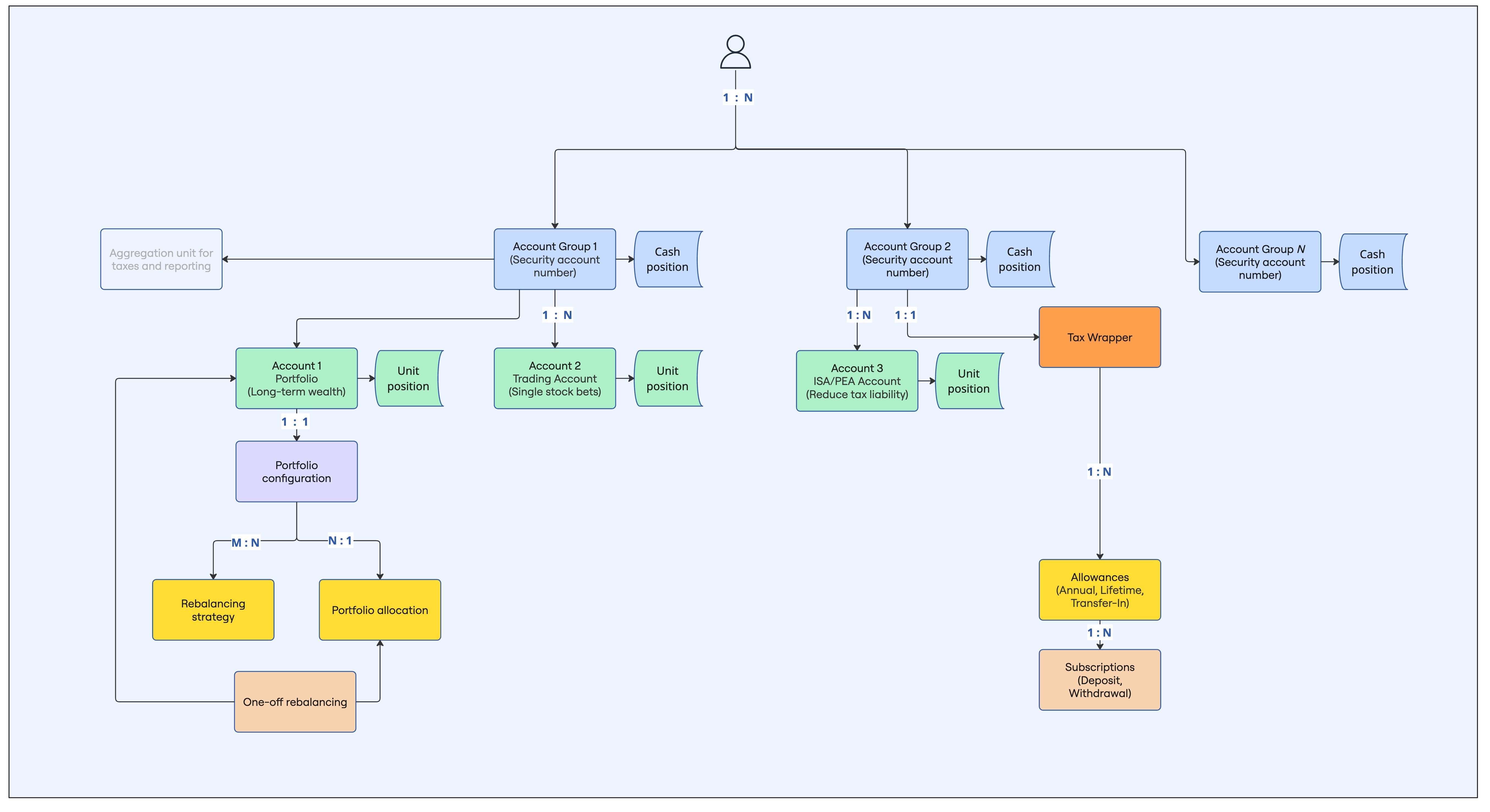

To support tax-wrapped investment accounts, the existing onboarding workflow (i.e., user, account, account group) has been adapted to indicate the type of tax wrapper that is being supported and any user-specific requirements needed to qualify for that wrapper.

In addition, a new step has been added to create the ‘tax wrapper’.

The following chart outlines the relationships between the relevant entities.

The next sections focus on PEAs and ISAs and their relevant integration considerations.