Upvest allows end-to-end processing of the entire corporate action (CA) lifecycle, including (pre-) notification, processing and cash and securities settlement of corporate actions.

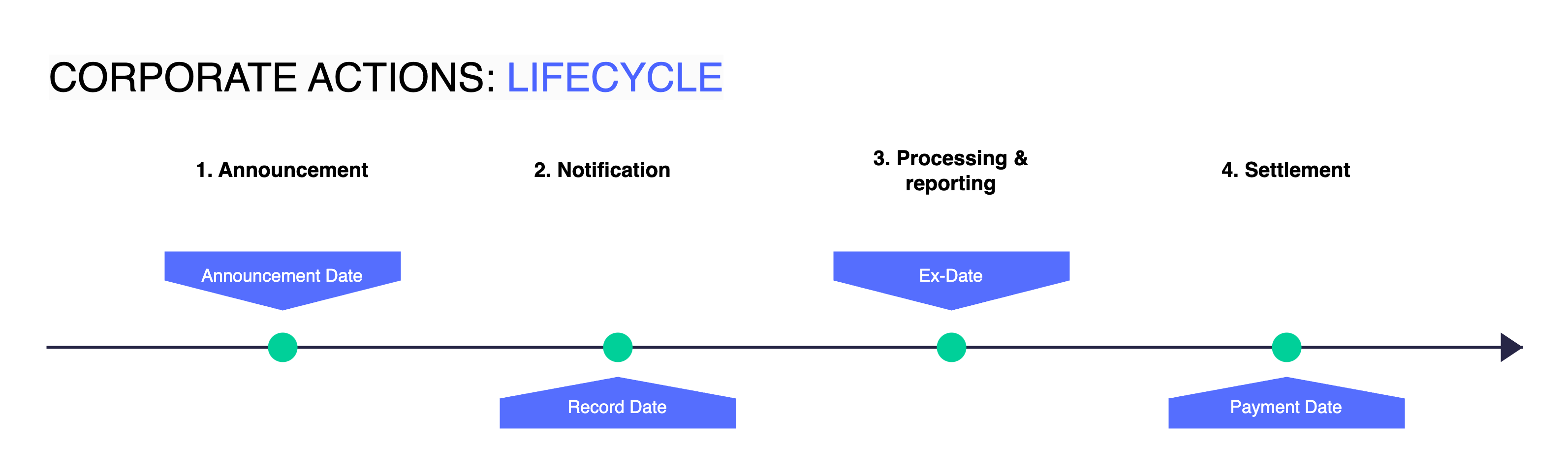

The following diagram outlines an exemplary lifecycle of a corporate action.

| 1. | Announcement | On the announcement date, the corporate action is declared by the issuer publicly (e.g., dividends, mergers, stock splits). |

| 2. | Notification | Notifications are the first phase in the lifecycle of a corporate action. Generally, corporate actions are usually announced weeks before they become effective and settled (i.e. booking of cash and/or securities). During this period, information about the nature of a corporate action becomes available and is distributed to market participants. Once a corporate action has been initiated, notifications of the impending corporate action are distributed in advance. -> Find more details here. |

| 3. | Processing & reporting | Upvest processes corporate actions for each end user.To do this, we allocate the resulting cash and securities transactions to the individual end users and update their (virtual) cash and securities positions accordingly. In the case of a cash dividend, for example, the corresponding taxes are calculated and the resulting net cash amounts are allocated to the end user's (virtual) cash account. The affected addressees then receive reports on the transactions executed as a result of the aforementioned corporate action. -> Find more details here. |

| 4. | Settlement | Upvest performs the required treasury transactions to clients according to the bookings made as described in the previous step. For this purpose, we send a settlement report to the client, which allows clients to reconcile the settlement transfer against the cash & security movements. |

In the following, we list some relevant dates that should make it easier for you to understand the concept of corporate action processing and the associated transactions.

You can find a more detailed glossary of corporate actions here.

| Announcement date | The issuer publicly declares the corporate action. |

| Ex-date | From this date, the share will be traded without a dividend entitlement. Buyers who acquire the share on the ex-date no longer receive a dividend. However, those who own the share before the ex-date are entitled to the dividend. |

| Record date | The record date is the date on which the issuer checks its records to identify its eligible shareholders. The authorised shareholders are those who are affected by the respective corporate action. |

| Election/ subscription period (if applicable) | Investors make choices (e.g., tender offers, rights issues). |

| Effective date | The corporate action is officially implemented. |

| Payment/ settlement date | Cash, shares, or other entitlements are distributed. - Cash-based The date on which the payment for a cash-based corporate action is made. - Securities-based For securities-based corporate actions, the payment date is the date on which the payment for securities is made (e.g., the securities resulting from a merger). |

| Final reporting date | Statements and confirmations are issued. |