In this guide, we expand on the knowledge we have outlined in the section 'Understanding portfolio orders' (if you have not already done so, we recommend that you read that chapter first).

Here, we will introduce you to the most important entities and processes in our rebalancing feature.

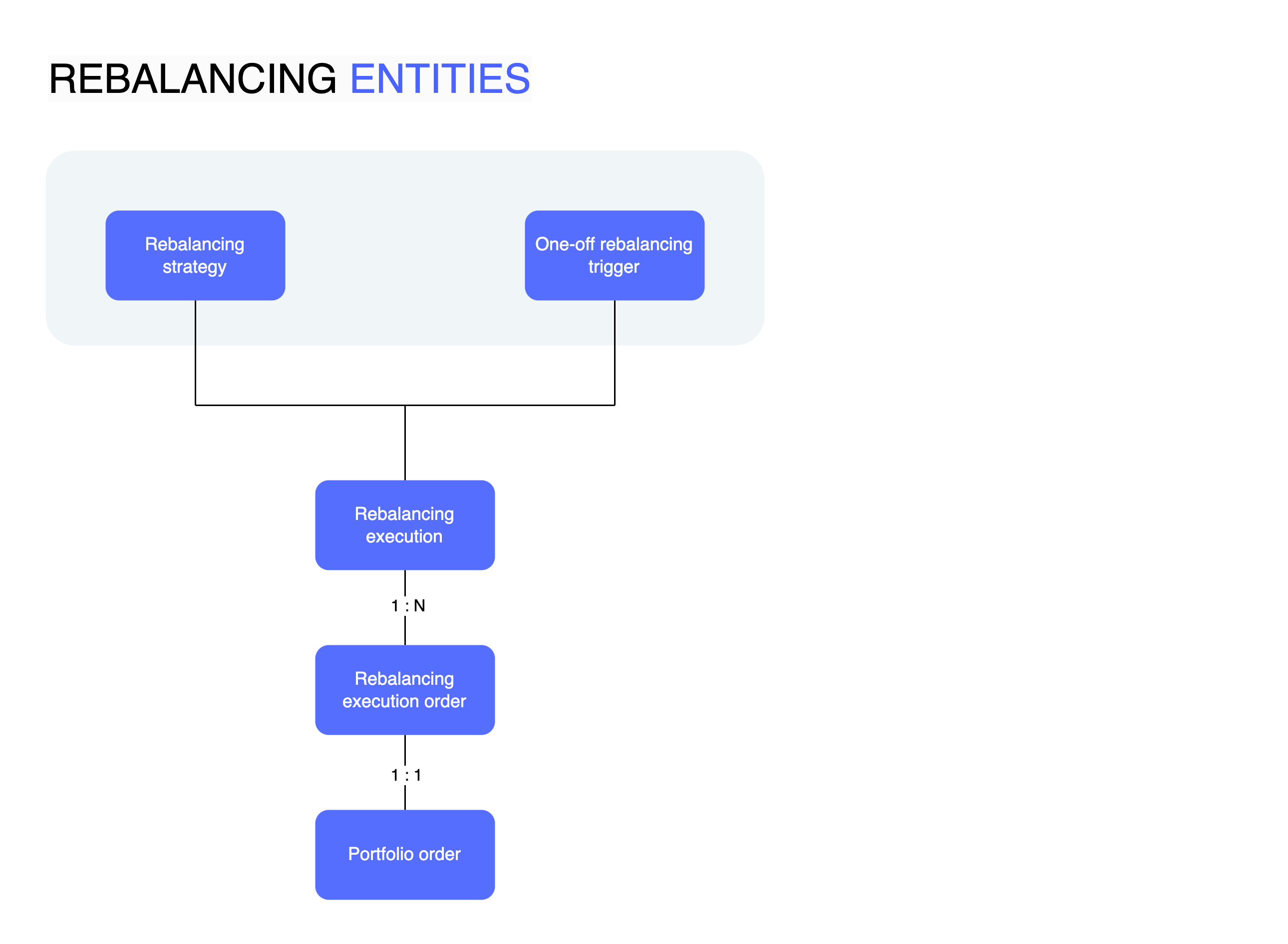

A rebalancing in the Investment API has the following layers:

A rebalancing execution is the unit that defines the entire scope of a rebalancing. It can be created either via the API by a one-off rebalancing request or within the Investment API by a previously defined automatic rebalancing strategy.

A rebalancing execution can be triggered for individual accounts or for a group of accounts.

Each individual rebalancing that is part of a rebalancing execution as defined above is represented in the Investment API as a ‘rebalancing execution order’. A rebalancing execution can therefore have one to many rebalancing execution orders, one for each account that is to be rebalanced.

A rebalancing execution order tracks the progress of a rebalancing as it is executed.

Learn more in the 'Rebalancing orders' section.

The portfolio order is the unit that manages execution at individual order level for rebalancing. Each rebalancing execution order has a portfolio order.

A rebalancing can be triggered in two ways, automatically or ad-hoc, whereby only the ad-hoc variant is currently supported.

With the Investment API, you can define automatic rebalancing strategies that manage a user's portfolio based on predefined rules. This can be time-based (e.g. once a year), threshold-based (e.g. drift greater than 2 %), threshold-based on definable asset classifications or a mixture of all.

Generally, one-off rebalancing triggers are used to directly reallocate your users' investments outside the predefined rebalancing cycles defined by a rebalancing strategy.

The Investment API allows you to trigger a rebalancing for all your user’s portfolio investments at any time. This functionality supports common portfolio management cases such as exchanging instruments and changing target weights for portfolio allocations, ensuring that you can react quickly to new (market) information or user requests at any time.

One-off rebalancing can be triggered at the portfolio allocation level as well as at the individual account level. Triggering one-off rebalancing for individual accounts is particularly relevant to accommodate the specific investment needs of certain users.

Portfolio orders created as a result of a rebalancing trigger - whether via the Investment API or via automated strategies - go through a slightly extended lifecycle compared to simple portfolio buy and sell orders. This is because rebalancing usually does not involve capital inflows or outflows from a portfolio investment, but instead restructures the existing portfolio investment to achieve a desired target state. Capital is thus first freed up by selling overweight instruments in the portfolio and then used to buy underweight instruments.

Transferred to the concept of a portfolio order in the Investment API, this means that the list of individual orders in the portfolio order object is dynamic and grows over time as rebalancing progresses.

To keep the overall process as transparent as possible, you will receive update webhook events when new orders are added.