Child accounts enable the legal guardians of end users who are minors to open accounts and trade on their behalf. These accounts automatically transition to personal accounts once the child is old enough to take control. Child account groups may focus on either portfolio management or investment trading as determined by the rules and regulations of the user’s residency. Local regulations will set other requirements such as setting the minimum legal age and determining the required supporting documents to prove guardianship.

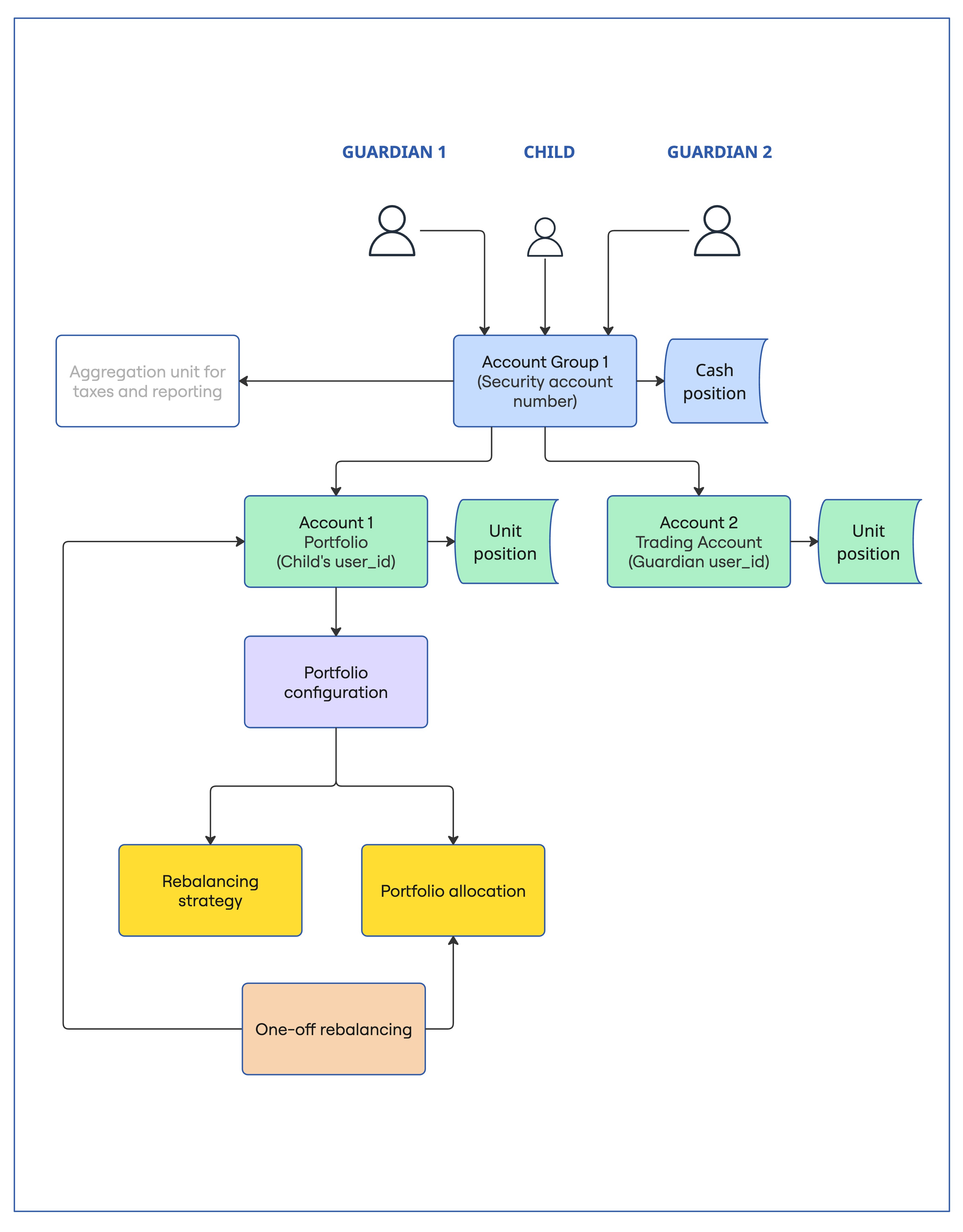

For both trading and portfolio accounts, the child is listed as the owner of the account. When submitting portfolio orders, the user id of the child is used. However, when submitting normal trading orders, you must use the user id of the guardian since they are the decision maker for the order.

Child accounts provide the ability for guardians to begin saving and investing for their children’s future. In addition, Upvest’s child accounts are designed to work with similar governmental saving plans focused on providing young individuals investment opportunities.

Currently, the child accounts functionality is focused on guardians and their children who have their sole tax residency in Germany with an expanded solution for other countries coming soon.

The building blocks of our solution includes:

- Onboarding: The Investment API supports the creation of both guardian and child users and the ability to map them to a single account group.

- Funding: Both guardians can fund the child account directly from a bank account in their names, either individually or from a joint bank account.

- Automated Transitioning: When a child becomes old enough to manage their own account, a child account group automatically transitions to a personal account group and retains a record of all historical transactions.

For the initial support of child accounts, the child must be 16 years old or under with support for 18 years old and under coming soon. Both the child and guardians must be residents in Germany and hold solely a German tax residency.

Both guardians must complete all required regulatory checks including the know your customer (KYC) and residency verifications as detailed in the Conducting Regulatory Checks guide. Guardians that already existing users with an active account do not require a new round of checks. Both guardians’ names must match the names listed on the child’s birth certificate.

The child user does not require full regulatory checks but must provide the child’s full name, their Tax Identification Number (TIN), date of birth, user identifier, and the child’s birth certificate. The purpose of the birth certificate is to verify that the guardians have authority to execute trading decisions for the child.

Children of Politically Exposed Persons (PEPs) must also complete PEP and sanctions checks.

The following changes have been made to support child accounts:

- New

/rolesand/role_assignmentsendpoints for the creation of guardian users. - Support of a new account group with

type=”CHILD”.