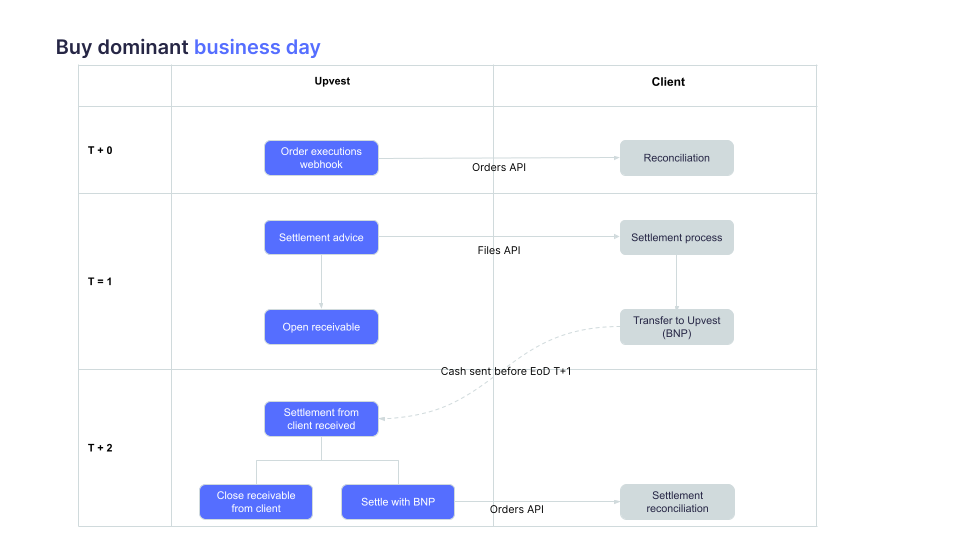

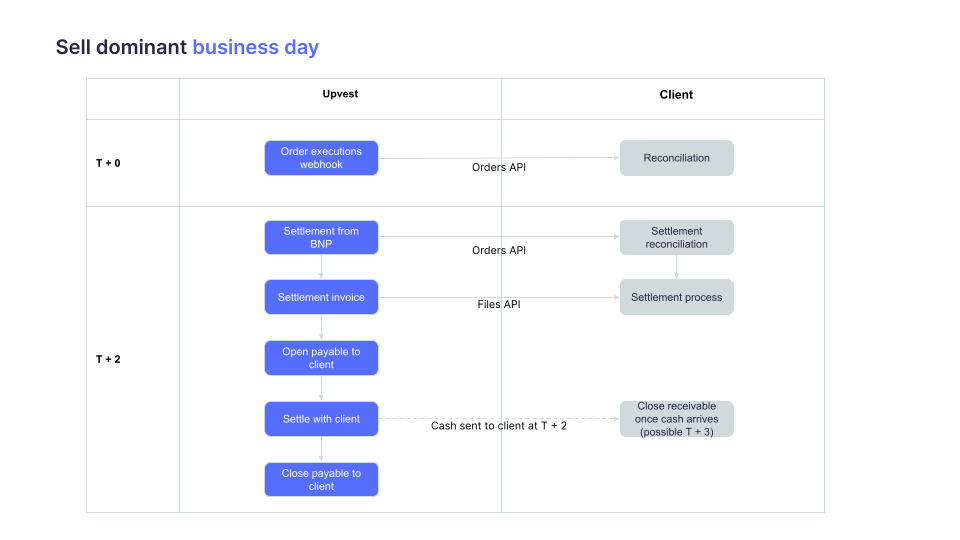

In this guide, you will learn how to settle your orders as a client with the Omnibus operating model. We also show you how to retrieve settlement reports via the Investment API and describe the exact process of a data retrieval and how such a report is structured.

In an Omnibus setup, Upvest supports settlement on a post-trade basis, while clients manage cash locks independently of Upvest's order execution.

We typically execute orders throughout the trading day so that we can issue a settlement report at the end of the day indicating how much cash is to be received or paid for the trading day.

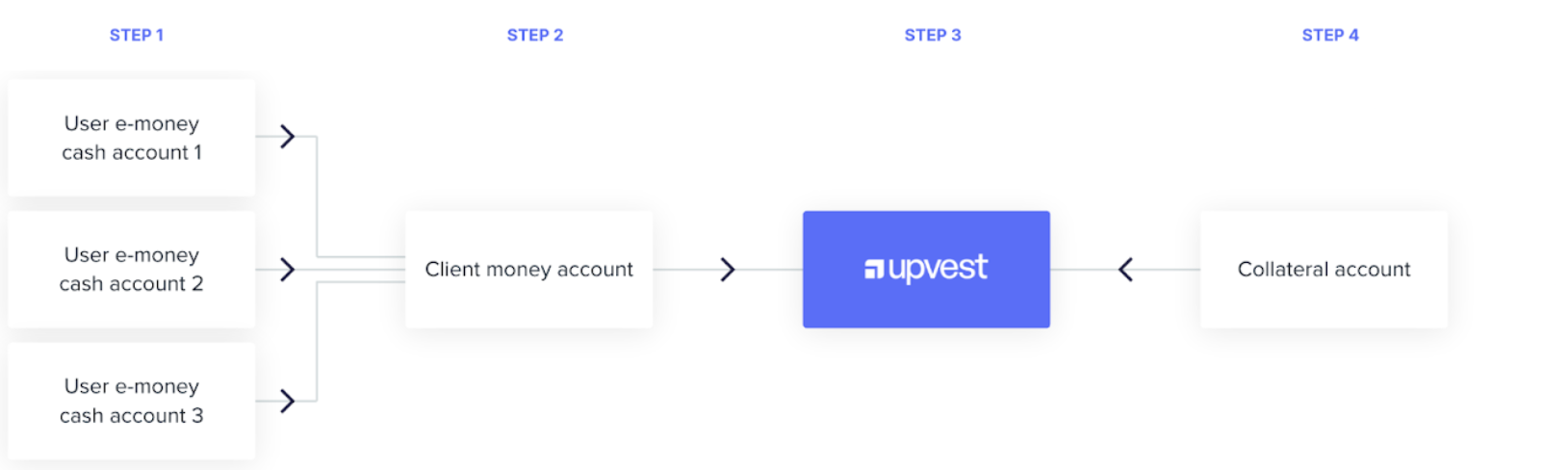

The following diagram illustrates the post-trade settlement flow:

| Step | Trading day | Description |

|---|---|---|

| 1 | E-money cash funds for order are redeemed and transferred to a dedicated client money account. | |

| 2 | T+0 | The order is placed and executed with the broker. |

| 3 | EoD T+1 | The outstanding cash funds are delivered to the broker for settlement. |

| 4 | T+2 | If there is a shortfall at T+2, the collateral account can be used to settle the outstanding order. |

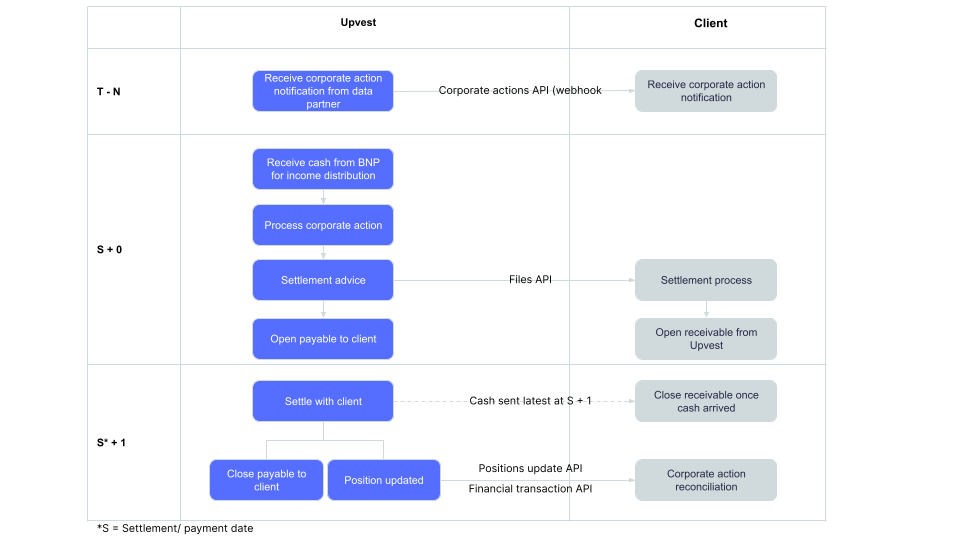

In the case of corporate actions distributions, the main difference is that no withholding tax is applied and upon settlement we generate a separate settlement invoice in the same nature as the trading settlement invoice. Once the settlement invoice is received, we transfer the applicable funds to our client.