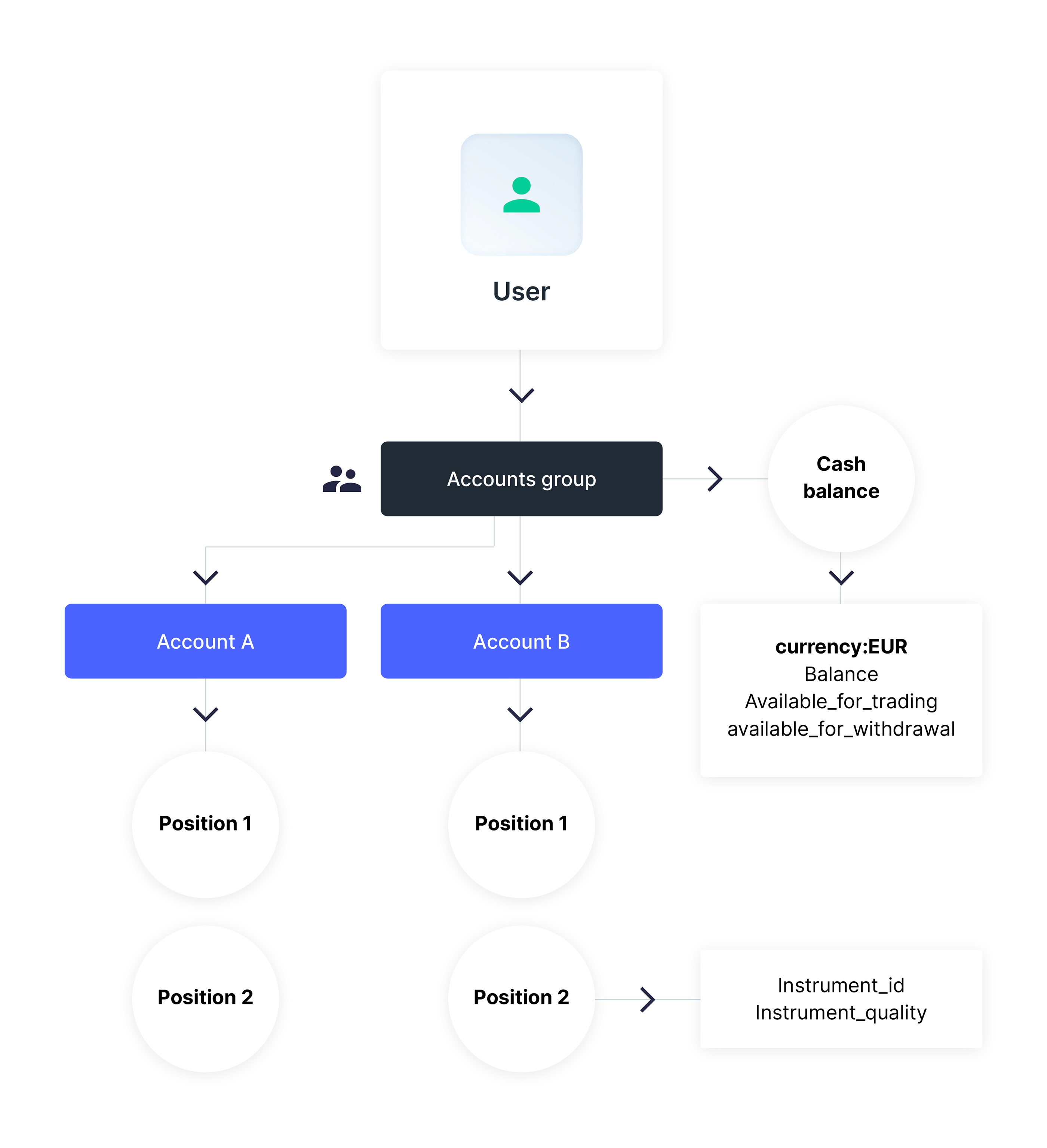

Cash balance refers to the portion of our user's investment portfolio assets that reside in cash. Fundings, withdrawals, and all order processes affect the cash balance of an account group.

In the Upvest platform the user’s cash balance is tracked at the account group level. Each account group will have a cash balance for a specific currency. At launch, all cash balances are assigned as EUR.

Cash balance support with different currencies will follow soon.

Cash balance has two general states

Available - cash is free and not allocated for use for a specific purpose.

Locked - cash that is “reserved” for the following reasons:

- Locked for trading - awaiting execution

- Pending settlement - awaiting settlement

Based on the cash balance states, cash balance can be interpreted in three main categories:

| State | Description |

|---|---|

| Balance | Total cash amount held by the account group. |

| Available for trading | Maximum cash amount that can be used to place new orders. |

| Available for withdrawal | Maximum cash amount that can be withdrawn. |

In some cases, it can be important to separate cash flows from different sources. For example, you always want to reinvest dividends and not allow them to be withdrawn or used for buy orders. In contrast, with some integration concepts it may make sense to withdraw the dividends as well as the proceeds from sell orders. This also means that you have to top up the user's cash balance separately for each buy order.

All of these cases are supported on the Upvest side.

Once you have gained an initial understanding of your business requirements, the Upvest team will assist you in selecting the required cash flow behaviour that meets these requirements.